- From Conversation to Conversion: Combine Chat and Payments

- Secure and Effortless: Cashless Payments With Apple Pay

- Get Started With Apple Pay and Apple Messages for Business

First things first, what is Apple Pay? With Apple Pay, you offer your customers an easy, secure, and private way to pay in your brick and mortar stores, within apps, in your webshop, and in Apple Messages for Business. That means Conversational Commerce is here! For shopping, customers can use the device that they carry on them every day: their smartphone. There’s no app to download, and they can use the cards they already have in their Wallet.

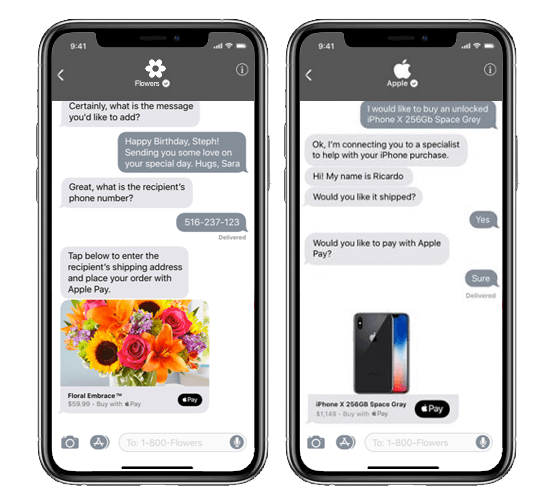

Moreover, with Apple Pay, making payments becomes as easy as sending a message. Because of CM.com’s unique offering of both Apple Messages for Business and Apple Pay, you can even enable payments within a mobile conversation. Consumers can use Apple Pay to pay right within Messages, or by asking Siri. Each of your chat interactions can now easily lead to new conversions.

From Conversation to Conversion: Combine Chat and Payments

On Apple Messages for Business, customers initiate the conversation whenever it's convenient for them. For example when consumers have questions about your products or services. But also during the purchase process, initiated from one of your marketing campaigns. It can be used for after-sales support to help customers get the most value out of their purchase, improving brand loyalty and repeated sales. Within Apple Messages for Business, you can offer Apple Pay for easy and secure payments for your products and services, without leaving the conversation. A payment request looks like a normal chat bubble but displays the familiar Apple Pay payment sheet. After the customer authorizes the payment, the payment request updates to reflect that payment is complete.

Secure and Effortless: Cashless Payments With Apple Pay

Apple Pay uses a device-specific number and unique transaction code. So, card numbers are never stored on Apple servers and are never shared by Apple with merchants. Every transaction on your customer’s iPhone, iPad, or Mac requires Face ID, Touch ID, or a passcode. And each time your customer takes their Apple Watch off their wrist, the passcode must be entered to access it. In addition, you don't receive your customer’s actual credit or debit card numbers, so you aren't handling actual credit or debit card numbers in your systems when customers pay with Apple Pay. Moreover, Apple Pay is easy to set up and gives your customers a simple and secure way to pay and donate with the devices they use every day.

Get Started With Apple Pay and Apple Messages for Business

Interested in offering your customers a secure and user-friendly way to pay online with Apple Pay? With CM.com’s unique offering of messaging channels and payment solutions, you can disclose the full Conversational Commerce flow from one platform. Contact us to start accepting Apple Pay payments within Apple Messages for Business.