- 1. Offer Various Payment Methods that Suit Your Target Audience

- 2. Know Your Customer and Reward Their Loyalty

- 3. Use Conversational Commerce for Personal Selling

The Black Friday weekend and Cyber Monday are originally American phenomena, but the Black Friday shopping frenzy has also found its way to Europe. Customers scour these days for gifts for the holidays. It doesn't mean you can sit back because sales will come naturally. Far from it! Competition is fierce. Your customers are bombarded from all sides with good deals, and as soon as they experience greater ease of payment elsewhere or get better “buy now pay later” (BNPL) terms, they're gone. Only by keeping a sharp focus on loyalty and offering the right payment methods will you achieve maximum conversions from Black Friday through Cyber Monday.

Three tips to optimize sales during Black Friday weekend:

1. Offer Various Payment Methods that Suit Your Target Audience

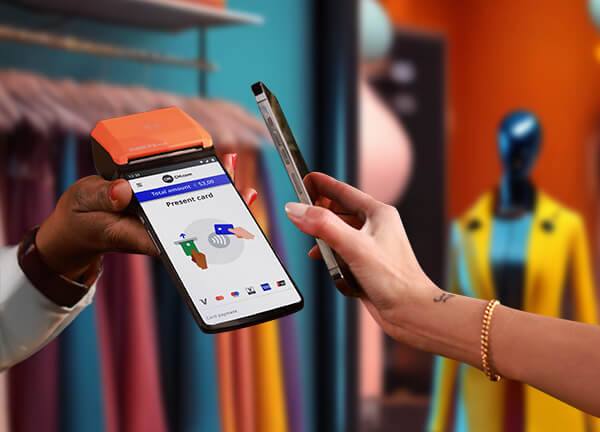

Offering “the ideal payment method” may seem obvious, but this is still a vital matter for retailers. Especially if they have an online and physical store. It often happens that the focus is on credit card and debit card options in-store, but the checkout online is anything but optimal. This happens, for example, when a standard payment plugin is implemented without thorough consideration.

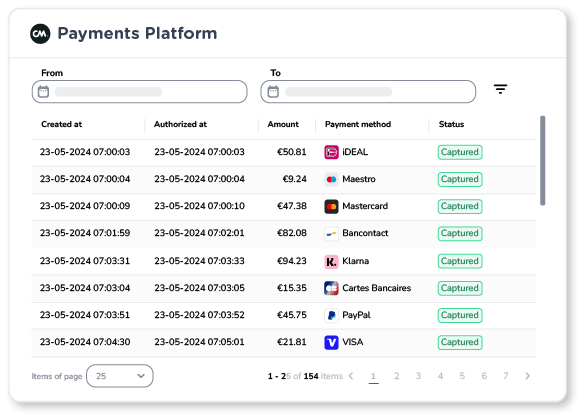

It's good to be clear in advance which purchases your customers are making with which payment methods. Because consumers have different preferences, which depend entirely on the type of purchase. In the Netherlands, small amounts are usually paid quickly and securely with iDEAL, or increasingly via digital wallets. If the purchase amount becomes higher, then people like to choose BNPL options such as Klarna, for example, which offers one-click payment. The long-standing credit card is chosen if it is a purchase to be insured. But there are several other variables to keep in mind:

Look beyond your local payment method. Make sure foreign customers can go with payment methods that are fast and familiar to them. iDEAL is by far the most widely used online payment method in the Netherlands, PayPal in Germany, Bancontact in Belgium and Cartes Bancaires in France;

Provide “Buy Now, Pay Later” (BNPL) payment solutions, by offering payments through services such as Klarna and Riverty, for example. Customers like to complete their purchase at the click of a button, without having to pay large amounts immediately. BNPL capabilities make them more likely to make larger purchases, or purchase more products at once;

Customers choose credit cards or PayPal for more expensive purchases that they want to insure or when they do not want to share their banking information with sellers. Also, these payment methods often offer (cashback) rewards. For more expensive purchases, these rewards add up quickly so another incentive to choose this payment method at a online store;

Accept digital wallets such as Apple Pay, Google Pay, WeChat Pay in addition to credit and debit cards to allow customers to order and pay smoothly. The last steps of the process (address information and payment) are completely skipped so the customer only has to think about their purchase;

Finally, it is important to make your online store accessible in multiple languages and currencies.

2. Know Your Customer and Reward Their Loyalty

The frenzy of the period surrounding Black Friday only reigns for a few days a year. But at the end of the day, ideally you want repeat customers year round. The Black Friday weekend is the optimal time to attract loyalty from two sides. On the one hand, reward customers you already have throughout the year with additional - customized - Black Friday deals. This way, customers feel seen and are more likely to choose you on Black Friday from the existing relationship. On the other hand, you can use Black Friday to start such a relationship with new customers. Get them to create a profile and reward a new account with a discount code, for example, if they sign up for a newsletter.

CM.com's Customer Data Platform (CDP) has everything you need to build the best possible relationship with your customers. This CDP aggregates all data and builds 360-degree customer profiles in real time. By deploying the CDP, you get to know returning customers really well, you can make highly targeted offers based on their data profiles and generate additional revenue well beyond Black Friday.

3. Use Conversational Commerce for Personal Selling

A purchase or sale in a physical store is always two-way communication, where online it has long been one-way. Conversational Commerce has changed this forever. Customers can approach your store through any platform they choose and start the conversation or place (AND complete) orders through social messaging channels such as WhatsApp, RCS and Instagram Messaging. Of course, virtual (AI) assistants and chatbots can also be used here.

The possibilities are endless. Help a customer find the right products with a chatbot as a virtual assistant. Or streamline the customer service journey with it. If you get to know (returning) customers well through the use of both CPD and Conversational Commerce, they will be open to receiving personalized Black Friday offers via WhatsApp or whatever messaging channel they prefer. By literally staying in conversation with them, helping them and keeping them engaged, trust grows. Thus, the step toward a conversion becomes smaller and smaller. Moreover, the direct payment links within conversations make Conversational Commerce a great way to not only target them around Black Friday and beyond with customized offers, but also to get them to make a purchase directly and without leaving the conversation.

The key to a successful Black Friday weekend is to offer customers exactly the payment experiences they want when making various purchases. And to get to know them well by engaging in conversation organically. This is how you cultivate loyalty back and forth. CM.com can help you as a business owner unlock and use these payment methods and messaging channels, from implementing the payment options your customers expect, to deploying Conversational Commerce. This way, you guarantee a truly personalized e-commerce experience for your customers that is sure to keep them coming back both around Black Friday and beyond.