- What Are “Moments of Truth”?

- The Messy Middle

- No More "Moments of Truth"?

- Be There When It Matters Most

What Are “Moments of Truth”?

“The moment when a customer/user interacts with a brand, product or service to form or change an impression about that particular brand, product or service.”

- Jan Carlzon, CEO of SAS

This is the first known definition of Moment of Truth (MoT) from the CEO of SAS, back in 1987. In 2005, Procter & Gamble defines two specific moments: the First Moment of Truth (FMOT) and the Second Moment of Truth (SMOT). They added the Third Moment of Truth (TMOT) in 2006. Google updated the concept with the Zero Moment of Truth (ZMOT) in 2011. Let's dive into these concepts.

Zero Moment of Truth (ZMOT). It's that moment when you grab your laptop, mobile phone, or any other device and start learning about a product or service, before buying.

First Moment of Truth (FMOT). This is when you are first confronted with a product or service, either offline or online. Procter & Gamble describes this as the decision-making moment: when a consumer chooses a product over the competitor's offerings.

Second Moment of Truth (SMOT). This moment is your experience with the product or service. After purchasing, but also every time you're using it or interacting with the service.

Third Moment of Truth (TMOT). During this moment, you will share your experiences via word-of-mouth, in a review, or on social media. This can be positive, negative, or neutral consumer feedback towards a brand, product, or service.

This is based on a rather linear customer journey. Today, we know that not one customer's journey is the same. And journeys are often not linear. Google researched customer journeys (and related models) thoroughly and shows most decisions are made in 'the messy middle of a journey.

Source: Think with Google

The Messy Middle

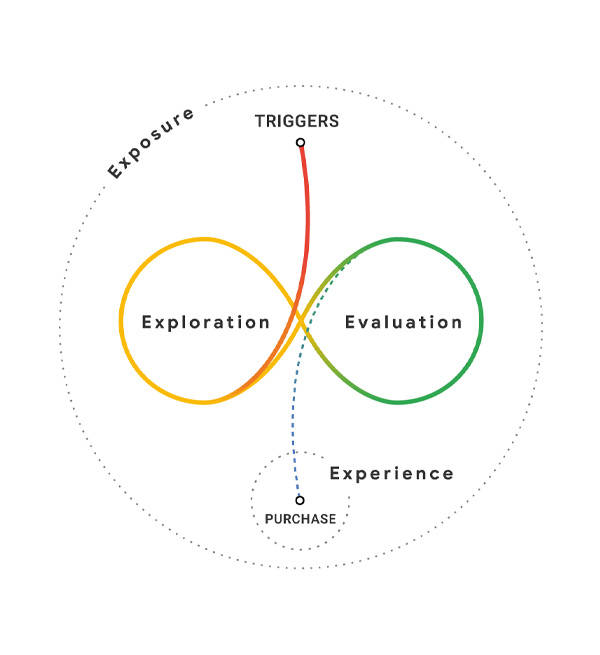

The authors of Google's 'Decoding Decisions: Making sense of the messy middle' explain the model with four E's: Exposure, Exploration, Evaluation, and Experience.

Exposure is the total sum of everything you've heard of seen about brands and products in a category. From your friends via word-of-mouth, a LinkedIn ad, a news article, a TikTok video, an out-of-home ad, or anything else. It's not just advertising, but your entire awareness. Crucially, exposure is not a phase, nor a singular touchpoint: it's always on and present throughout the decision-making process.

Exploration and Evaluation. The model includes an infinite loop, visualising how consumers are more informed and autonomous. They're looping between exploring and evaluating available options while processing information before they're ready to purchase. Time is not set: some will move fast between exploration and evaluation, some will skip it completely, and some will take their time for lengthy research.

Experience. Not in the messy middle, but important to mention. This is the experience the customer has with the purchased product or service and the brand, feeding their exposure. Customers will share their experiences with others, both offline and online.

No More "Moments of Truth"?

If you now think: well, we can forget about the "moments of truth". Think again. "Moments of truth" matter more than ever. Especially since anything can impact 'Exposure'. If we look back at the initial definition of Jan Carlzon in 1987, it's still relevant. Every interaction can impact their thoughts of a brand, product, or service. And nowadays, customers are more in touch with financial services than ever before.

However, "moments of truth" can be different for customers than they are for companies. Every interaction counts, but in some cases, it's a make-or-break moment. Let's see what their "moments of truth" are.

Be There When It Matters Most

Finance comes with emotion. Any change in your financial situation, whether good or bad, will trigger some emotion. Think of it: when do you contact your financial advisor or company? Only when you need support. These critical moments can be life-changing events, such as a new home. However, it can also be a car crash or something small like losing your credit card. Completely different events, but they all matter. Especially at that moment. If the support is not as expected, customers might consider leaving this company.

Let's look at it from an insurer's perspective. What can you do to help your customers best? Be there when it matters most! Help them with empathy. We'll take three situations to see what you can do.

Car Accident. Your customer is still at the scene of the accident trying to reach his insurance company. You can imagine he is experiencing a lot of stress. It's important he can speak directly to a human agent, who can help him. Make sure you have an emergency number available with human, empathic support.

Moving. Your customer is buying a new house. They need to act quickly and want to get updates on the status of their new insurance. Help them with automated updates.

Pregnancy. A new family member is oftentimes a happy moment. Changes in their insurance can be made via a virtual assistant. However, it is important to help them in an empathic way. Make sure to teach your Conversational AI how to respond to emotional situations, and implement a handover to a human agent.

In any situation, it's important to offer your customers the best possible experience. Find out what the "moments of truth" are for your customers, to assist them in the best possible way.