- The Evolution of Mobile Banking

- Advantages of WhatsApp Business Platform over USSD

- Key Benefits of WhatsApp Business Platform for Financial Services

- The Limitations of USSD

- WhatsApp for Banking at Your Fingertips

- The Future of Banking with the WhatsApp Business Platform

WhatsApp has revolutionised the way we communicate and stay connected with our friends and family. The popular messaging app has over 2 billion active users worldwide, making it a highly valuable platform for businesses to reach out to their customers.

In this article, we'll compare USSD and the WhatsApp Business Platform and highlight the main differences between the two.

The Evolution of Mobile Banking

Mobile banking has come a long way since its inception, offering customers greater convenience and accessibility to their financial services.

One of the early forms of mobile banking was USSD (Unstructured Supplementary Service Data), which allowed customers to access basic banking services. These included checking account balances and performing simple transactions through text messages. While USSD was a convenient solution for customers, it was limited in terms of functionality and user experience.

With the advent of new technologies and platforms, the use of USSD has been largely overshadowed by more advanced forms of mobile banking. (However, this doesn’t take away what USSD can do. In some markets, a large percentage of the banking population prefers the simplicity and availability of USSD.)

Advantages of WhatsApp Business Platform over USSD

The integration of banking services through WhatsApp has the potential to revolutionise the way we manage our finances. With its wide reach and user-friendly interface, WhatsApp can quickly become the go-to channel for customers to access their banking services.

Key Benefits of WhatsApp Business Platform for Financial Services

Increased Customer Convenience: With the integration of banking services through WhatsApp, customers can access their accounts and perform transactions whenever and wherever convenient. No need to visit a branch or have their computer at hand.

Enhanced Customer Engagement: By providing a new channel for customer communication and support, financial institutions can improve customer engagement and increase customer satisfaction and conversion.

Increased Efficiency: By automating routine tasks, such as account enquiries and payments, financial institutions can reduce the workload on their staff and increase efficiency.

Cost Savings: Integrating banking services through WhatsApp can help financial institutions save on costs associated with maintaining physical branches and call centres

Increased Security: WhatsApp uses end-to-end encryption to secure messages, ensuring that all customer information is protected.

The Limitations of USSD

While USSD certainly has its uses, it also has its limitations.

Limited Functionality: USSD only offers basic banking services and lacks the advanced features and capabilities of modern mobile banking solutions.

Complex User Interface: The text-based interface of USSD is often difficult to navigate and use, leading to a poor user experience for customers.

Security Concerns: USSD lacks the security measures and encryption technology of modern mobile banking solutions, leaving customer information vulnerable to cyber attacks.

WhatsApp for Banking at Your Fingertips

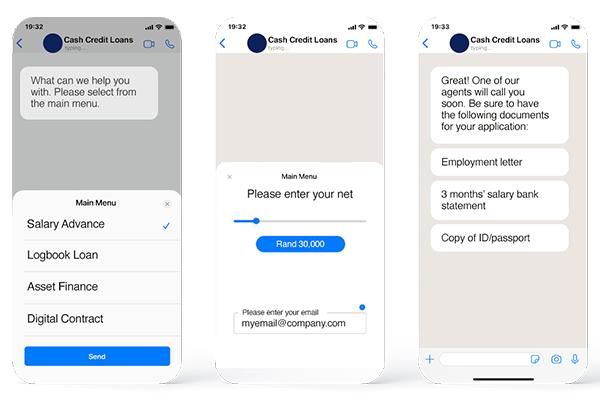

Banks can provide financial services through WhatsApp. The platform allows banks to create and manage customer interactions, automate customer service, and securely transact with customers. Integrating banking services with WhatsApp offers a unique opportunity for financial institutions to reach and engage with customers in a more personal and convenient way.

The WhatsApp Business Platform provides various capabilities that allow banks to provide a seamless and scalable customer experience. These include account balance enquiries, transaction history, bill payments, and more. The API also supports secure end-to-end encryption, ensuring that customer data and transactions are protected. With the API, banks can automate customer service and provide fast and accurate responses to customer enquiries.

Most financial institutions use a WhatsApp Business Solution Provider to streamline the development and integration process. Registered professionals, such as the CM.com team, understand the unique challenges and requirements that enterprise customers face and can remove costly hurdles before they occur.

The Future of Banking with the WhatsApp Business Platform

The choice between USSD and WhatsApp Business Platform for financial institutions depends on their specific needs and requirements. While USSD may be a convenient solution for basic banking services, its limitations make it a less viable option than the WhatsApp Business Platform.

On the other hand, the WhatsApp Business Platform offers a more advanced and user-friendly solution for financial institutions looking to improve the customer experience and offer a wider and more personal range of banking services.

In conclusion, the WhatsApp Business Platform offers a wealth of benefits and possibilities for both financial institutions and customers. As technology continues to evolve, we will likely see more integration of financial services through popular messaging platforms in the future.