Mobile Identity leverages the unique characteristics of the SIM card to authorise and verify users. This provides a secure authorisation, verification and fraud prevention method that ensures only authorised users can access sensitive information.

The SIM card's unique properties make tampering difficult, Mobile Identity offer stronger security than traditional methods.

Users don't need complex passwords or extra devices; their mobile phone becomes the access key.

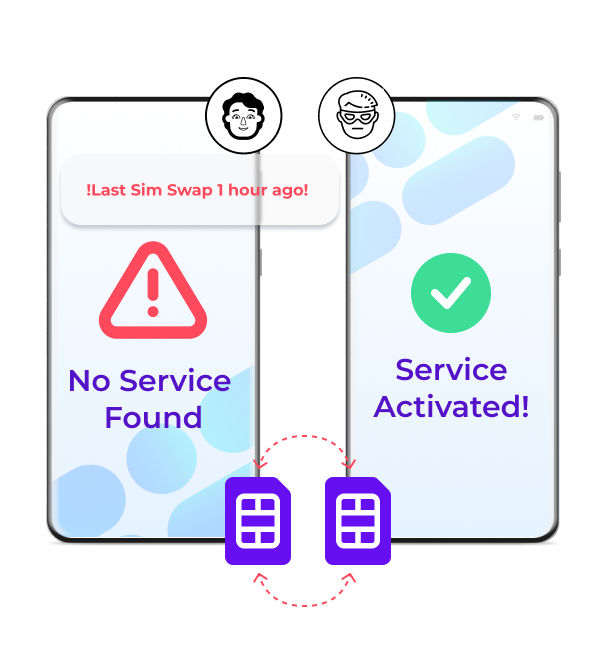

Detect and prevent account takeover scams such as SIM Swap fraud by checking when the last SIM swap occurred.

Lower operational costs by reducing the need for physical tokens and complex password management systems.

Authenticate users with a new, quick and secure verification channel: Number Verify. It leverages the unique characteristics of the SIM card to verify users, all they need to do is fill out their phone number. The verification process works in the background via network operators, making it inherently safer and more secure than traditional authentication methods which rely on passwords, knowledge-based authentication, physical tokens or OTPs.

Verify users silently in the background

Simplify the authentication process

Reduce fraud

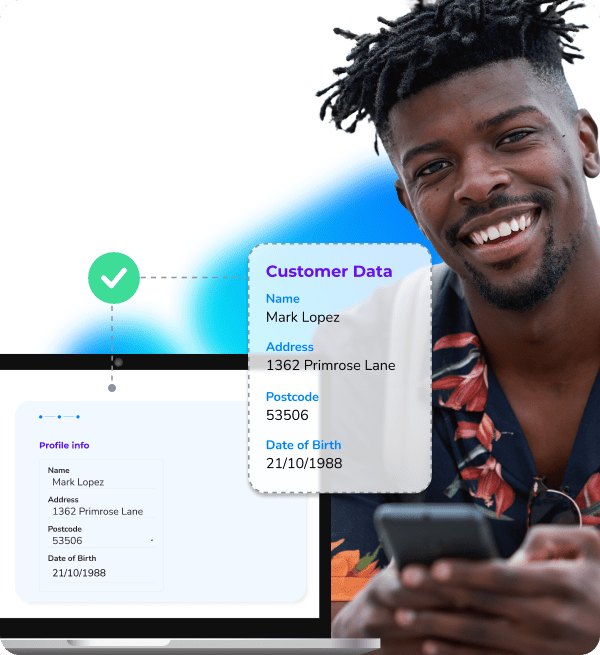

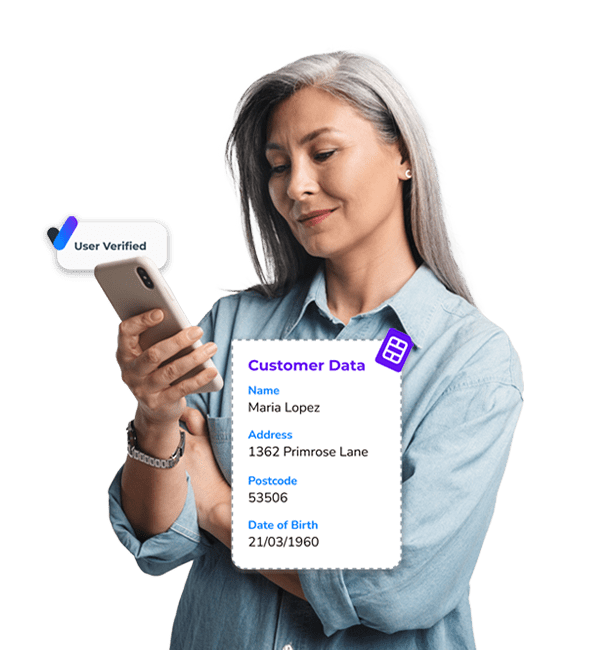

Mobile to Person Match uses a customer's mobile number to verify their name, address, postcode and date of birth against live data from their mobile network operator. This allows businesses to confirm mobile number ownership using first-party data while ensuring privacy through hashing and compliance with consent guidelines like GDPR.

Verify customer data

Secure Anti-Money-Laundering (AML) policies

Grow your database by verifying more users

SIM Swap fraud occurs when fraudsters manage to persuade mobile carriers to transfer the telephone number of a victim to a SIM card in their possession, giving them access to sensitive information such as text messages and phone calls. Our Takeover Protection Service determines when a SIM card is changed and will flag it as potential fraud. This will put you in charge of the situation and help prevent this fraud.

Use real-time data

Set up fraud alarms and signals

Stay in control

Onboard and grant access to users in a smooth and secure manner

Protect monetary transactions from fraudsters

Monitor activity to prevent unauthorised access

Verify and authenticate users by confirming their mobile numbers

Comply with strict data protection and user authentication regulations

One API, multiple OTP channels. Choose the perfect channels for your audience and improve the user experience.

One API for the most secure and user-friendly verification services including OTPs and Number Verify. Only pay per successful verification.

Build and configure your own tailored verification and security solution with nine available channels to perfectly fit existing processes.

With cybercrime on the rise, it's more important than ever to secure your online data and customers - if you don't want to become the next security breach headline.

With our Mobile Identity Services supported by Sekura.id, you'll stay on top of international security regulations whilst offering your customers the highest level of security.

Select a region to show relevant information. This may change the language.