One API for the best verifications: Number Verify, OTP channels using optimised routing. Our verification services are plug-and-play.

Regardless of which channel you use or how many trials it takes, you only pay for successful verifications, without additional channel costs.

With optimal routing to relevant channels and our platform's global reach, we can ensure a close to 100% delivery rate for your verification messages.

Say goodbye to the headache of setting up and deciding what verification channels you should adopt and implement to keep your business secure. Our team does that for you. And the best part? You only pay when a verification is successful, without additional channel costs.

Our team does the hard work for you. Fallback channels, number configuration, priority routing and fraud prevention are all accessible via one easily integrated connection.

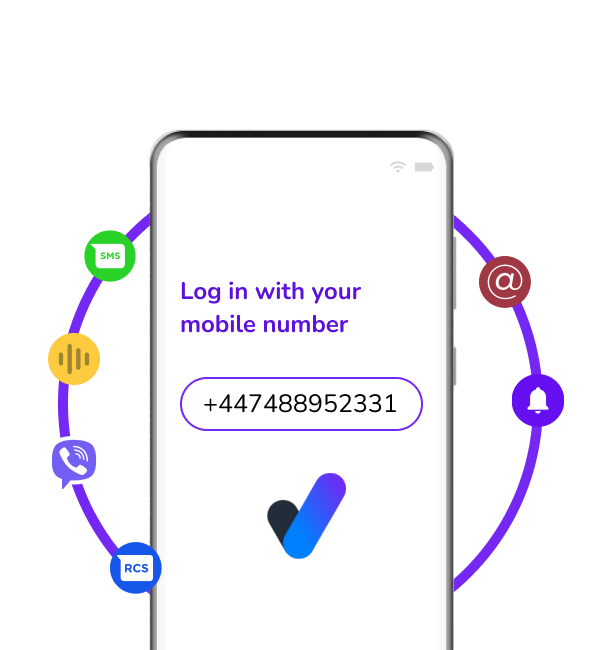

When sending out verification checks, our solution prioritises the best verification channels for your use case: From Number Verify (silent SIM card verification) to OTPs.

Add an extra security layer to secure your digital services. No need to manually monitor to detect fraudulent traffic - our solution will do that for you to save time and resources.

Authenticate users with a new, quick and secure verification channel: Number Verify. It leverages the unique characteristics of the SIM card to verify users, all they need to do is fill out their phone number. The verification process works in the background via network operators, making it inherently safer and more secure than traditional authentication methods which rely on passwords, knowledge-based authentication, physical tokens or OTPs.

Enhanced security

More convenient

Fraud prevention

Cost-effective

Prioritise the latest technologies like Number Verify to authenticate users. If Number Verify is unavailable our smart verification routing will send out a security code to the most secure and convenient OTP fallback channel for your audience. Successful verification is guaranteed.

Improve delivery and conversion rates

Decrease non-delivered OTPs

Optimise your costs (pay for successful verifications)

Be compliant with local regulations

Onboard and grant access to users in a smooth and secure manner

Protect data or transactions from fraudsters

Monitor logins and accounts to prevent unauthorised access

Double-check and verify users by confirming their mobile numbers

Set up traffic rules and monitoring to detect and prevent fraud

One API, multiple OTP channels. Choose the perfect channels for your audience and improve the user experience.

Build and configure your own tailored verification and security solution with nine available channels to perfectly fit existing processes.

CM Safeguard contains extensive tools to help protect accounts from fraudulent activity. From Destination Management to Recipient Limits and Alerts.

With cybercrime on the rise, it's more important than ever to secure your online data and customers, if you don't want to become the next security breach headline. It can be difficult to choose between security solutions, and using tools from multiple suppliers can even be counterproductive and leave your business vulnerable for fraud. This is why we strive to make it easy - One API for all verification use cases.

Select a region to show relevant information. This may change the language.